Did you know the most profitable car of sports car maker Porsche is actually its family friendly SUV Cayenne? Wait what! How? Enter building to Customer's Willingness to Pay (WTP).

In a FirstRound.com post Madhavan Ramanujam, Simon-Kucher & Partners, shares the story of Porsche's counter-intuitive move in the mid 1990s.

In a FirstRound.com post Madhavan Ramanujam, Simon-Kucher & Partners, shares the story of Porsche's counter-intuitive move in the mid 1990s.

In the mid 1990s Porsche's annual sales were a third of what they’d been the decade earlier when it almost died. The company badly needed a turnaround.

So Porsche "designed the car around what customers needed, valued and were willing to pay for – in short, around its price. All the items customers weren’t willing to pay for, like Porsche’s famous six-speed racing transmission, were thrown out, even if their engineers loved them."

In contrast Fiat Chrysler, which was also looking for a hit, "focused its development process on engineering and design, settling on a price for the car at the very end. Market performance was a disaster. It performed so poorly it eventually forced the company to issue temporary layoffs. Even though Fiat Chrysler was six times larger than Porsche, the company failed to craft a hit. That’s because the company thought about product first and price last. "

“On the other hand, Porsche’s masterstroke was thinking about monetization long before product development for the SUV was in full speed, then designing a car with the value and features customers wanted the most, around a price that made sense. The result was total corporate alignment: Porsche knew it had a winner, and had the confidence to invest accordingly,” Ramanujam says.

So how to get product monetization right?

- Have the Willingness-to-Pay talk early.

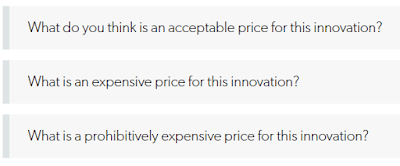

Talk about price early in the product development process and figure out the acceptable, expensive and prohibitive prices. - Investigate How You Charge As Much as What You Charge

Apart from the price you charge how to chose what are you monetising - pricing by no. of users, product pricing, performance pricing etc. What works for you? Ramanujam shares how Michelin executives revisited the company’s long-established monetization model to release a improved product.

- Don’t settle for a one-size-fits-all solution.

“If it's in a fountain it's free, if you put it in a bottle it's $2, if you put gas in it’s $2.50, if you put in a minibar it's $5. It's the same water. Your customers are different. They have different needs, they have different values, and they have different WTP. The only way to cope with this is to embrace customer segmentation.”

Ramanujam gives a step by step guide on how companies' can get their pricing right, the pitfalls you can dodge, case studies etc. Click here to continue reading.